When traveling, travel insurance is usually helpful. In particular, consider which things you consider important to insure. A lot is possible, but not everything is necessary. The main reason for taking out travel insurance is the help you get in an emergency. Think of an unplanned early return journey. Or a longer than planned stay including extra travel costs as a result of an accident, illness, or death. These types of events usually cost you a lot of money and time, when it is not covered anywhere else.

Roughly speaking, two types of travel insurance can be distinguished: continuous travel insurance and short-term travel insurance. Both travel insurance insures you and/or your belongings during your holiday or weekend away. The basic cover of travel insurance usually offers assistance and cover for extra costs that you have to incur as a result of, for example, illness, an accident, or death.

What is continuous travel insurance?

Do you go on holiday or a weekend away more than once a year? Then continuous travel insurance is in many cases the cheapest. With that of the ANWB you are assured of the trusted help of the Daman on your holiday (s), but also during weekends away.

What is short-term travel insurance?

If you go on holiday once a year, a short-term variant is usually the cheapest. Short-term travel insurance ends automatically after your holiday and you only pay a premium once.

What risks does travel insurance cover?

This differs per provider and per insurance. At Daman, you are insured with the basic travel insurance cover for unforeseen expenses that may occur during your trip. Think of repatriation from abroad, extra transport and accommodation costs, and replacement accommodation.

Moreover, with travel insurance from the Daman, you can consult for medical advice from a local doctor on a team of expert care providers, nurses, and doctors. That is great if you need medical help abroad. You can expand your travel insurance with additional cover. For example, the additional cover for medical costs. Because your health insurance often only reimburses the Dutch rates for medical treatments, while the costs for this can be higher abroad.

Alami Travel Insurance Plans by Daman

Daman Travel Insurance plan is called Alami which in Arabic means “My World”. It’s a travel health insurance package that allows you to open a whole new world of possibilities that puts your mind at ease. With Alami, you can enjoy a hassle-free trip outside the UAE with various plan choices to choose the number of days of coverage.

Switch to Daman for a worry-free trip abroad. Our Outbound Travel Health Insurance Plan – Alami, provides you with a wide variety of cover options if urgent and unexpected medical treatment is needed during your trips abroad. Daman will maintain your peace of mind no matter where you fly around the world.

Alami Bronze Plan Benefits

The Bronze Plan comes with 15 days and 30 days coverage period with an annual benefit limit of AED 500,000 per person. The 90 days plan comes with an annual limit of AED 200,000 per person on the trip.

Coverage: Worldwide Emergency – Excluding UAE

Duration/Premium:

- 15 days for AED 99

- 30 days for AED 139

- 90 days for AED 99 (Worldwide Emergency – Excluding UAE, USA, and Canada Coverage)

| Plan Name | Alami – Bronze | |

| Coverage Period | Single Trip: 15 days and 30 days Plans | Single Trip 90 days |

| Annual Benefit Limit | AED 500,000 Per Person Per Trip | AED 200,000 |

| Territorial Limit | Worldwide excluding USA, Canada, and UAE | |

| Special Conditions | · Coverage for EMERGENCY TREATMENT only. Elective (Planned) treatment not covered. · Coverage outside UAE is limited to 15 days per treatment. | |

| Emergency Treatment1 | Coverage | |

| Inpatient & Day Treatment | 100% covered | |

| Hospital Accommodation & Services | 100% covered | |

| Consultant’s, Surgeon’s & Anesthetist’s Fees and other fees | 100% covered | |

| Diagnostics (X-Ray, MRI, CT-Scan, Ultra Sound, etc.), Laboratory (Specialized investigation and scan including but not limited to MRI, Scan, Endoscopies) | 100% covered | |

| Pharmaceuticals | 100% covered | |

| Ambulance Services (in Medical emergency cases, subject to General exclusions) | 100% covered | |

| Other Benefits | Coverage | |

| Companion Accommodation2 (Maximum limit of AED 300 per day) | 100% covered | |

| Medical Evacuation (through International Assistance Service providers only) | 100% covered | |

| Repatriation of Mortal Remains to country of origin (AED 10,000)2 | 100% covered | |

| Maternity not covered | ||

| International Emergency Assistance Services (Through Service Providers Only) | ||

| Emergency Medical Advice | ||

| Medical Referrals, In-Patient Case Management | ||

| Assistance with Prescription Medicine | ||

1. All Emergency cases do not require pre-authorization but should be notified to Daman within 24 hours by calling +971 2 4184888 or email intl_assistance@damanhealth.ae.

2. Covered on Reimbursement Basis. Emergency Out-patient Treatment services covered on a reimbursement basis.

Daman Alami Annual Multi-Trip Plan

The Alami Multi-Trip Plan gives coverage of medical Worldwide Emergency – Excluding UAE for the multi-trip duration total Premium is AED 469.

| Plan Name | Alami – Bronze | |

| Coverage Period | Annual Multi Trip | |

| Annual Benefit Limit | AED 500,000 Per Person Per Policy Year | |

| Territorial Limit | Worldwide | |

| Special Conditions | · Coverage for EMERGENCY TREATMENT only. Elective (Planned) treatment not covered. · Coverage outside UAE is limited to 90 days per treatment. · A single holiday or business trip may not exceed 90 days | |

| Emergency Treatment1 | Coverage | |

| Inpatient & Day Treatment | 100% covered | |

| Hospital Accommodation & Services | 100% covered | |

| Consultant’s, Surgeon’s & Anesthetist’s Fees and other fee | 100% covered | |

| Diagnostics (X-Ray, MRI, CT-Scan, Ultra Sound, etc.), Laboratory (Specialized investigation and scan including but not limited to MRI, Scan, Endoscopies) | 100% covered | |

| Pharmaceuticals | 100% covered | |

| Ambulance Services (in Medical emergency cases, subject to General exclusions) | 100% covered | |

| Other Benefits | Coverage | |

| Companion Accommodation2 (Maximum limit of AED 300 per day) | 100% covered | |

| Medical Evacuation (through International Assistance Service providers only) | 100% covered | |

| Repatriation of Mortal Remains to country of origin (AED 10,000)2 | 100% covered | |

| Maternity not covered | ||

| International emergency assistance services (Through Service Providers Only) | ||

| Emergency Medical Advice | ||

| Medical Referrals, In-Patient Case Management | ||

| Assistance with Prescription Medicine | ||

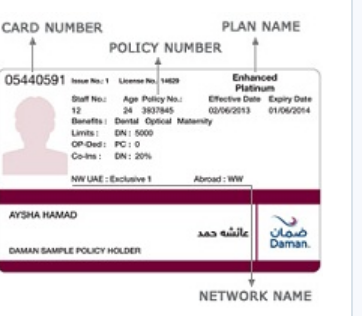

For more information and purchasing of these plans visit Daman Travel Insurance Portal.